Consulting services can provide valuable insights, strategic guidance, pecialized

1901 Shiloh, Hawaii 81063

Consulting services can provide valuable insights, strategic guidance, pecialized

1901 Shiloh, Hawaii 81063

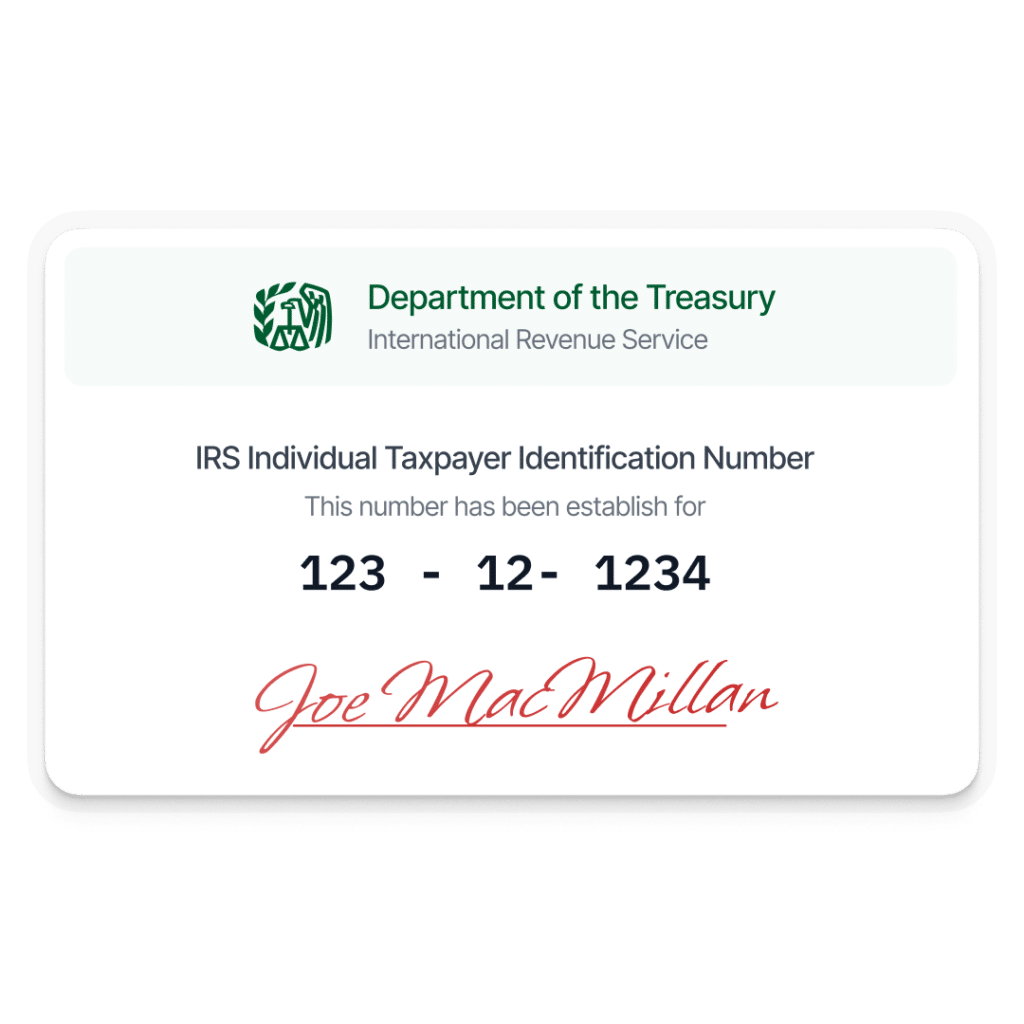

An ITIN (Individual Taxpayer Identification Number) is issued by the IRS to individuals who need to file U.S. taxes but aren’t eligible for a Social Security Number. It’s used for tax reporting purposes only and doesn’t authorize work or provide benefits.

Contact UsTo apply for an ITIN, complete IRS Form W-7 and submit it along with your federal tax return and the required original or certified identification documents. You can apply by mail, in person at IRS Taxpayer Assistance Centers, or through authorized Acceptance Agents.

Contact UsTo apply for an ITIN, you must submit a completed Form W-7 along with valid original documents or certified copies that prove your identity and foreign status, such as a passport. Other acceptable documents

Contact UsAn ITIN (Individual Taxpayer Identification Number) is a tax processing number issued by the IRS to individuals who are not eligible for a Social Security Number. It is used primarily by non-resident aliens, resident aliens, and others who need to file U.S. taxes but do not have SSNs. The ITIN begins with the number 9 and is formatted like an SSN (e.g., 9XX-XX-XXXX). It does not authorize work in the U.S. or provide eligibility for Social Security benefits. ITINs help individuals comply with U.S. tax laws and facilitate the processing of tax returns.

File U.S. Taxes – Allows individuals without an SSN to legally file federal tax returns.

Claim Tax Credits – Eligible taxpayers can claim benefits like the Child Tax Credit.

Open Bank Accounts – Many banks accept ITINs to open checking or savings accounts.

Proof of Residency – Can help establish U.S. residency for tax or immigration purposes.